Contents

LLC Name Verification

The first step to forming an LLC is to verify that the name you want to use isn’t already taken by someone else. This can easily be accomplished by searching through the public records in the Corporations Division of Michigan’s Department of Licensing and Regulatory Affairs (LARA). You can access the corporations database by clicking here.

Once you have arrived at the search page, you’ll want to focus on the “search by entity” option at the top. Simply enter the business name you’d like to search for, and then scroll down to the bottom and click search. LARA will display a list of all potential matches on the following screen.

If no matches are found for your chosen name, then great! That means it’s available for you to snag and you can proceed directly to step two >>

If matches are found, you’ll need to do a bit more digging to see whether or not you can use the name. In most cases however, if matches are found it’s best to scratch the name off your list and think of a new one, as using a name that is too similar to an existing business, or “stealing” a name that another business has already assumed is often more hassle than it’s worth. At best, it will only confuse your potential customers/clients, and at worst, it can damage your reputation and result in legal action from the existing business, especially if that business is larger and more established.

For the sake of this article, I’ll talk a little bit about how to know whether a name is up for grabs even when a match is found, as I believe it is important to understand so that you can protect yourself and your brand in the future.

In order to know whether a name is currently available, you’ll have to understand the difference between a DBA/assumed name and legal name. To put it bluntly, DBA’s are fictitious and offer no legal protections in Michigan, even when registered with the state. They exist primarily to provide transparency to customers. A legal name on the other hand, is the official government name for your business. This is the name you’ll use for taxes, banking, contracts, legal proceedings, etc. and once a legal name has been registered in the State of Michigan, nobody else can register the same name.

When doing an entity search in LARA, it will include both DBA’s and legal name matches. To differentiate between the two, you’ll want to look for the entity abbreviation immediately following the name. If the name appears as “Clark Kent Enterprises, LLC” (or L.L.C.) then this means it is a legal name match. If the name appears as “Clark Kent Enterprises” without the LLC, then this is most likely a DBA, in which case you’ll want to click through to the entity summary page to verifiy.

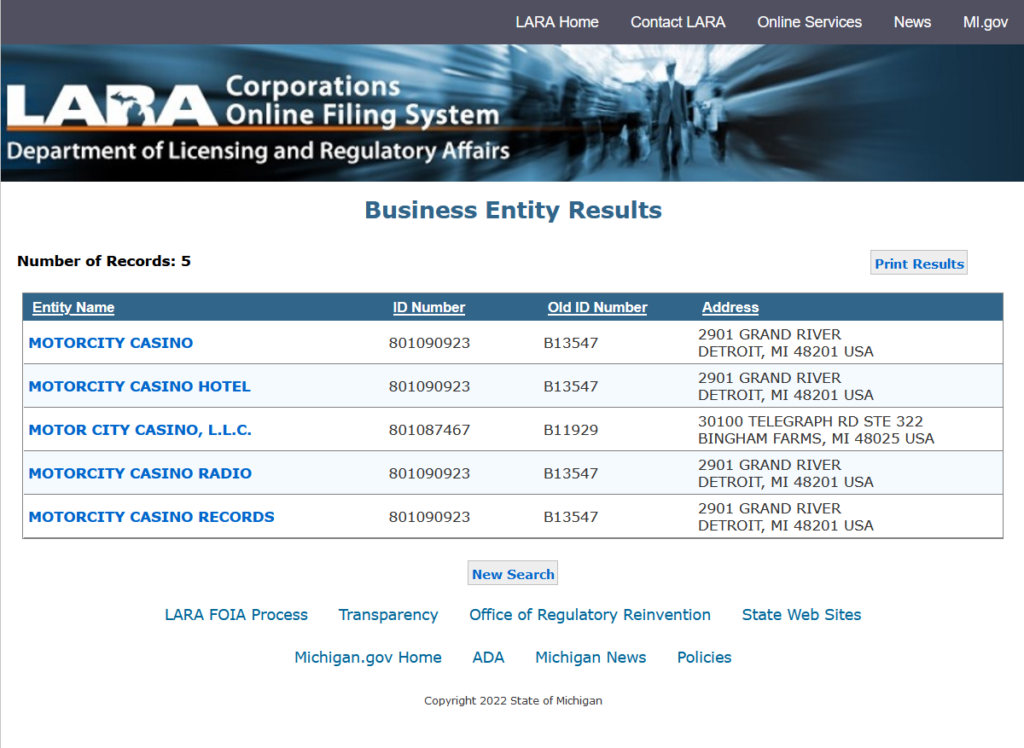

To give an example, lets take a look at the filings for Motor City Casino and Hotel. Our search for “Motor City Casino” displayed the following results. Notice that the first two results do NOT contain an entity abbreviation, leading us to believe that they are DBA’s of another entity. The third match in the list, however, does include an L.L.C. abbreviation, which means that this one is most likely a legal name.

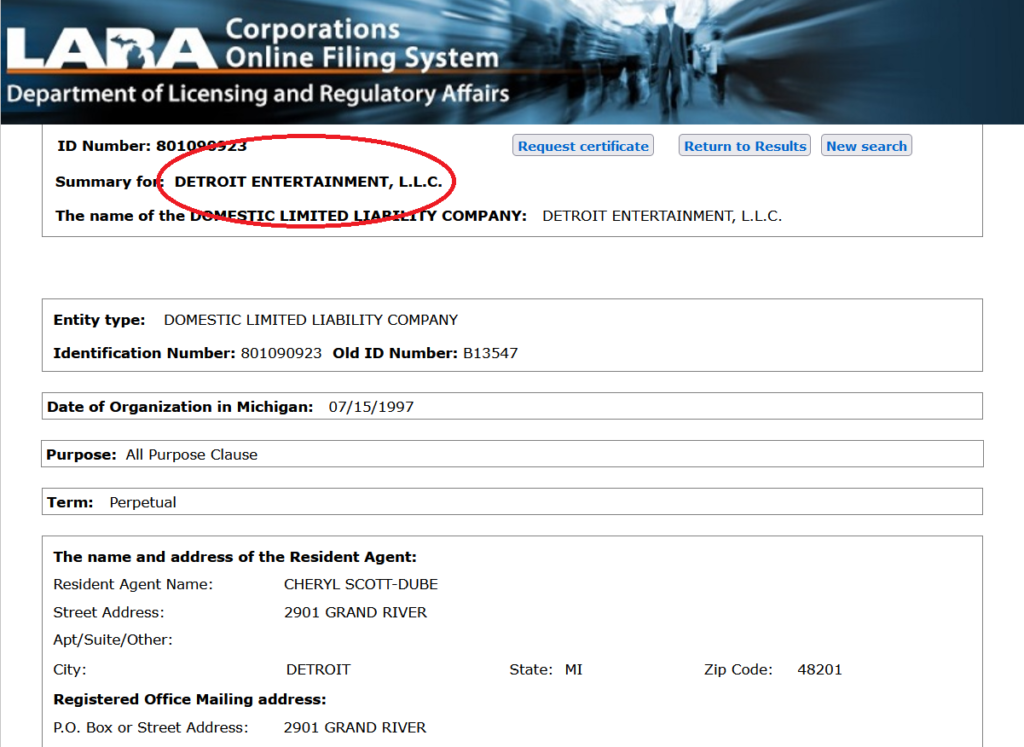

To verify our assumptions, we’ll want to click on each match in the list to view the corresponding entity summary page, and do a bit of investigating. Upon clicking through on the first two matches, we see that they link to an entity summary page for Detroit Entertainment, L.L.C.

Upon investigation, it seems our assumptions were correct. The first two matches in the list are registered as DBA’s of Detroit Entertainment, L.L.C. But what about the third match?

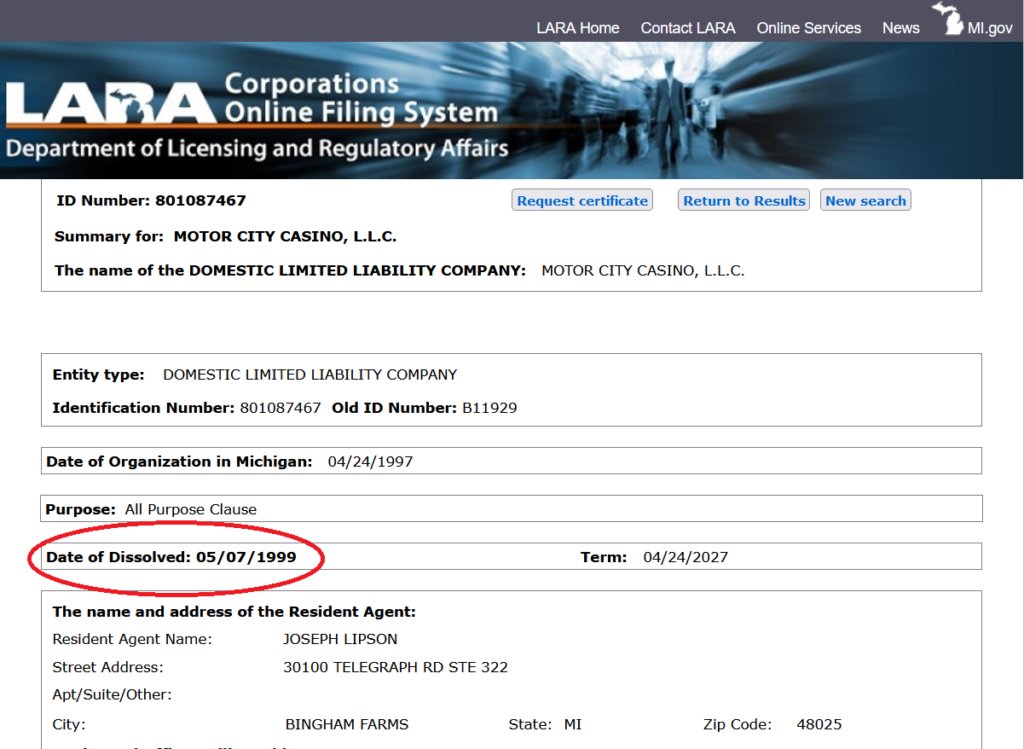

Clicking through to the entity summary page for the third match shows us the following information:

We can see at the top that this is in fact a legal name match. There was an LLC registered as Motor City Casino, LLC at one point, however, notice where it says “Date of Dissolved: 05/07/1999“. This means that the entity was formally dissolved (and apparently restructured under a different legal name) in 1999.

So what does this mean? In this scenario, since there are no currently active legal name matches, and the only matches are DBA’s of another entity, the name “Motor City Casino, LLC” is technically up for grabs. You could go in and register this name for your own LLC.

That being said, although DBA’s offer no legal protections on their own, a business can register their DBA as a trademark, and in this case a quick google search shows that Motor City Casino (and all of its derivatives) are registered trademarks of Detroit Entertainment, LLC. Meaning that even though you technically can register a Michigan LLC with the name “Motor City Casino, LLC”, you will most likely face legal action for trademark infringement if you actually try to use the name.

There are certain circumstances where “stealing” a DBA may be appropriate, however. I know of one story where two individuals agreed to form a partnership under a chosen name, but one partner decided to register the chosen name as a DBA of her own LLC (of which she owned 100%) in an attempt to cut the second partner out. In this scenario, fortunately, since DBA’s offer no legal protections, the second partner was able to cut her losses, form her own LLC, and take back the name which was being “held hostage” by the first partner.

This pretty much wraps up the name verification step. But one other important thing to note is that there are ways somebody can steal your name even when registered as a legal name. Legal names are only protected while an entity is in good standing with the state, meaning you absolutely need to file your annual statements. Failure to file your annual statements will eventually result in your business losing it’s name protection (amongst other issues), at which point anyone can go and register the name for themselves. For the purposes of this article I won’t discuss how to determine if a business entity is in good standing, as the only thing you really need to know is to make sure you keep YOURS in good standing by filing your annual statements every February when they’re due.

Choosing a Michigan Registered agent

The next step on the list is to choose a Michigan Registered Agent. LLC’s are required to appoint a Registered Agent with a local Michigan street address. Registered Agents can not use a PO Box address.

Registered Agents must be willing to accept legal documents on behalf of the LLC. They must also be willing to have their name and address listed on public records.

You have three options for obtaining a registered agent:

- Do it yourself for free. You can be your own Registered Agent, however, this means that you’ll need to have your name and address publicly available, which provides very little privacy, especially if you’re using your home address. Anyone will be able to search for and find your name home address, and there is no way to remove it from public record without removing yourself as the registered agent for the LLC. You also must have a stable mailing address, as if you move without updating your registered agent address, you can miss important legal documents that are mailed to your previous address.

- Set up your LLC with us and use our Registered Agent Service for only $19.99 per year. Click here to learn more about the service and what we offer. This option would provide you with peace of mind and privacy. Our mailing address will be listed on public records for your LLC, and we’ll handle processing and forwarding of important legal documents. We also offer local mail pickup by appointment for urgent mailings, and we’re conveniently located inside the city of Detroit, not somewhere out in Okemos or Lansing.

- You can use any other registered agent services. Pricing and quality varies, but feel free to do a google search for “Michigan Registered Agent” and shop around.

Filing The Articles of Organization

The next step on the list is to prepare and file your Articles of Organization with the State of Michigan. To do this, you’ll need to pay a $50.00 filing fee directly to the state. This fee is unavoidable, and you’ll have to pay it regardless of if you choose to use a service such as LegalZoom, NOLO, Michigan Business Coach, etc. or if you choose to set up your LLC on your own.

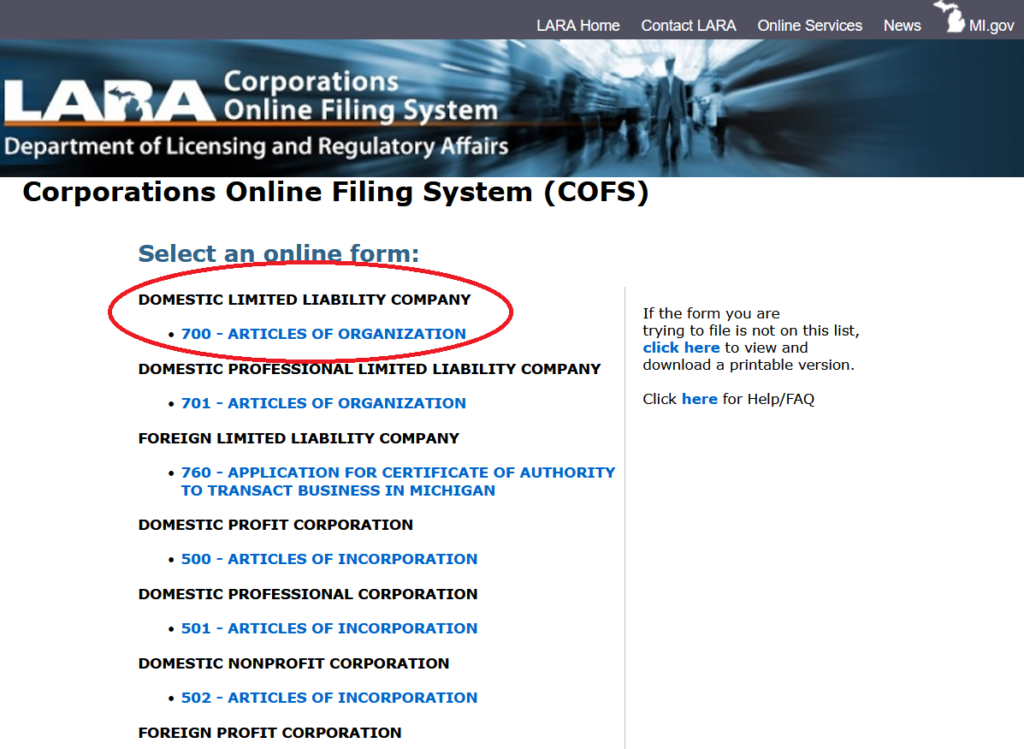

Articles of Organization can be filed online or via postal mail. To file online click here to be redirected to the Michigan Corporations Online Filing System (COFS), then click on the first option titled “700 – Articles of Organization”

NOTE: Do not use form “701 – Articles of Organization” as this is for forming a Professional Limited Liability Company (PLLC). Certain licensed professionals such as Attorneys, Dentists, and Doctors must form a PLLC instead of an LLC. But most people will want to form a regular LLC.

COFS will walk you through the steps to complete your Articles of Organization. You’ll need to list the Registered Agent, you’ll need to briefly describe your business purpose, and choose whether or not your LLC will be managed directly by it’s members (the owners) or by appointed managers.

Once you have completed your Articles of Organization, simply follow the on screen prompts to submit the documents to the state. Then, wait to receive a response. If there are no issues, you’ll receive a certified copy of your Articles of Organization electronically within 5-10 days, along with a PIN and CID that you’ll need to file your annual statements. You will want to keep all of these in a safe and secure location.

If your filing is rejected for any reason, the state will notify you, and you’ll need to correct the issues before resubmitting.

I don’t recommend filing your Articles of Organization by mail, as the turnaround time is slower, however, if you prefer you may also download a paper copy of the Michigan Articles of Organization here.

Once completed by hand, you’ll need to mail this document to the following address:

Michigan Corporations Division

PO Box 30054

Lansing, MI 48909

The Operating Agreement

Arguably the most difficult step in the process. Writing a solid LLC operating agreement is not an easy task, but it is crucial.

The Operating Agreement is essentially the “Constitution” for your LLC. It lays out the laws that govern the company, such as percentage of ownership between members, how the company will be managed, how votes will be determined, when new members may be added, etc. You are NOT required to file this document anywhere, it exists simply for your benefit. You’ll want to keep this document on file to reference as necessary, as it will provide much needed guidance in the future should any issues arise.

Without any background in legal writing, and without any experience operating businesses, I don’t recommend you try to write your own, but aside from the DIY approach, you have a few options:

- Hire a small business attorney to write a bulletproof operating agreement for you. This is going to be the most expensive option, and is probably going to be overkill for smaller businesses or single-member LLCs. That being said, hiring an attorney will undoubtedly yield the best result.

- Form your LLC with us and select our “Entrepreneur” package for $49.99. We’ll complete all the other steps to set up your LLC for you and we will write a custom operating agreement for your company that we guarantee you’ll be satisfied with. Unlike some of our competitors, we don’t upcharge based on complexity. Our price is $49.99 flat, regardless if you have one member or 5 members.

- Form your LLC with another company for $149.99+

No matter what you decide, writing an Operating Agreement is a necessary step in the process of forming your LLC the right way. Once you have one in place, you can move on to the next and final step.

Obtaining an EIN

The final step to forming an LLC in Michigan is to complete the IRS application for an EIN number. EIN stands for “Employer Identification Number”. You can think of it as the Social Security Number for your LLC. It is how the IRS identifies your company for tax purposes.

LLC’s are not required to obtain an EIN if they do not plan to hire employees, however, we recommend knocking this step out anyways, as you’ll likely need an EIN to set up a business bank account.

The good news is that this step is relatively straightforward. You can apply for an EIN online for free, and you’ll receive one instantly. To complete the application, click here.

Most businesses should be able to complete their application online, however, in certain situations you may need to complete a paper application and mail it to the IRS.

To complete a paper application, click here to download a blank copy of IRS Form SS-4. Once completed, you will need to mail the document to the following address:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

Alternatively, you can fax your completed SS-4 to 855-641-6935

Once you’ve sent off your completed SS-4, you’ll need to allow some time for the IRS to receive it and issue your EIN. You should receive a confirmation letter in the mail, however, this process can take up to 10 weeks. Once you receive your confirmation letter you’ll want to keep it in a safe and secure place, as it is difficult to receive another one if you lose it.

Additional Steps

At this point, you’re officially done setting up your new LLC. Congratulations! The only thing left to do is to set up a business bank account. Now that your company is ready for business, you’ll need a business bank account to handle payments and bills. You never want to use your personal checking account for handling business related transactions (or vice versa), as mixing business and personal finances can result in serious consequences.

For the sake of this article, we wont discuss our personal recommendations for business bank accounts, but if you’re curious to learn more you can click here to read our full article on the topic!

Summary

Now that we’ve walked through each step of forming a Michigan LLC, lets do a brief recap starting from the top.

- Name Verification – The first step is to verify your LLC name is available. You can accomplish this by doing an entity search in LARA.

- Registered Agent – The second step is to choose a registered agent. You can use yourself, you can use our optional service, or you can shop around and choose a different Michigan Registered Agent service.

- Articles of Organization – The third step is to file your Articles of Organization with the state of Michigan. You can accomplish this online or by mail. Or you can purchase any of our LLC formation packages and we’ll take care of this for you.

- Operating Agreement – The fourth step is to draft an LLC Operating Agreement. You can write your own, hire someone else to write one for you, or purchase either our Entrepreneur or Executive LLC formation package and allow us to take care of all of these steps, including the Operating Agreement for you.

- EIN – The fifth and final step in the process is to complete the IRS application for an EIN. You can do this instantly online for free.

- Business Bank – An additional step you’ll want to take is to set up a business checking account for your new LLC. Click here to read our article about small business banking and get our personal recommendations.