Table of Contents

Overview

Traditional business plans typically adhere to the following format:

- Executive Summary

- Company Description and Elevator Pitch

- SWOT Analysis

- Breakdown of Goals and Objectives

- Breakdown of Products and Services

- Market Research and Competitive Analysis

- Leadership and Key Personnel

- Marketing & Sales Plan

- Operations Plan

- Financial Analysis and Projections

Executive Summary

The executive summary comes first in the document, but is the last step you should complete. This is because it summarizes all the sections after it. When writing the executive summary, think of it as if you needed to convey all the key information contained in your plan to a busy CEO who only can only spare 2 minutes to skim through it. You want everything in this section to be clear and concise. Don’t beat around the bush, just get straight to the point and don’t use a bunch of words. This is not the section to try to showcase your writing skills.

Company Description & Elevator Pitch

In this section you’ll describe your company in detail and state your elevator pitch.

An elevator pitch is a brief verbal description of your company and your value proposition. Think of it as if you were literally on an elevator with someone, how would you get them to understand what you do and why it’s important in 60 seconds or less? A good rule of thumb for elevator pitches is to keep them between 20-100 words. Less is more when it comes to an elevator pitch, as the goal is simply to spark interest and get a second conversation, not to make a sale or land an investment right there on the spot. Some examples of good elevator pitches are:

Most tourists booking online care about price, and hotels are one of the highest costs for when traveling. On the other hand, platforms like Couchsurfing have proven that over half a million people are willing to lend their couches or spare bedrooms. We have created a platform that connects travelers with locals, letting them rent our rooms, or even entire places. Travelers save money, and locals can monetize their empty rooms- we just take a 10% commission.

- Rick’s Bridal sells high-end wedding gowns and accessories to brides in New York City. For twenty years, Rick’s has served over 25,000 satisfied brides through our six locations.

- Merchant Machine helps small businesses quickly and easily save money on their credit card processing costs by comparing the leading options in the market. It’s completely free to the end user, there are no obligations and takes just one minute to do.

SWOT Analysis

You can use a template to type your SWOT analysis up or you can simply use a piece of scratch paper and a pen. The important thing is getting it done. For strengths and weaknesses you’ll want to focus on internal items. Things that are unique to you, such as competitive pricing or exclusive patents, that are not influenced by external factors. For opportunities and threats, you’ll want to look outwards and consider both external and environmental factors.

Once you’ve feel you’ve completed a decent SWOT analysis, go ahead and add it to your business plan, either as subsections with bullet points, or simply copy and paste your worksheet as an image if you’ve typed it up.

Feel free to download and use our template below:

Powered By EmbedPress

Goals and objectives

In this section you’ll outline the various goals and objectives you hope to achieve. The SWOT analysis should help you in completing this section.

Use the SMART method for determining your goals, SMART goals are:

- Specific. Make sure your goals are specific and not too vague.

- Measurable. Arguably the most important part. Goals mean nothing if you can’t regularly track your progress.

- Achievable and Realistic. A goal of $5M in sales during your first year sounds nice, but is most likely not achievable or realistic. Maybe start with $50K

- Time-bound. A good business plan will have different goals for different time periods. You should have monthly, quarterly, 1-year goals, and 5-year goals.

Breakdown of products and services

In this section you’ll describe the various products and services you sell, including product descriptions, price, cost, etc. You’ll also want to describe any future products/services you plan to launch to the best of your ability.

This part is pretty straightforward. If your business sells a lot of different SKUs then you can just list general information about each product.

Once this is done, you can move on to the next step.

Market Research and Competitive Analysis

Leadership and key personnel

This is another fairly straightforward section. You’re just listing the key players on your team, along with their skill sets and plans for further development.

For most new businesses this will be a very short section, as there may only be one or two key players involved. That’s okay! Once you’ve listed the key players on your team, move on to the next section.

Marketing and sales plan

In this section you’ll describe in-detail your desired brand positioning along with the various marketing and promotion tactics you’ll use.

Some things to consider:

- Brand image

- Products, services, and prices

- Promotional methods

- Place/distribution methods

- Social media strategy

- Customer value maximization

- Marketing partnerships and joint ventures

Operations plan

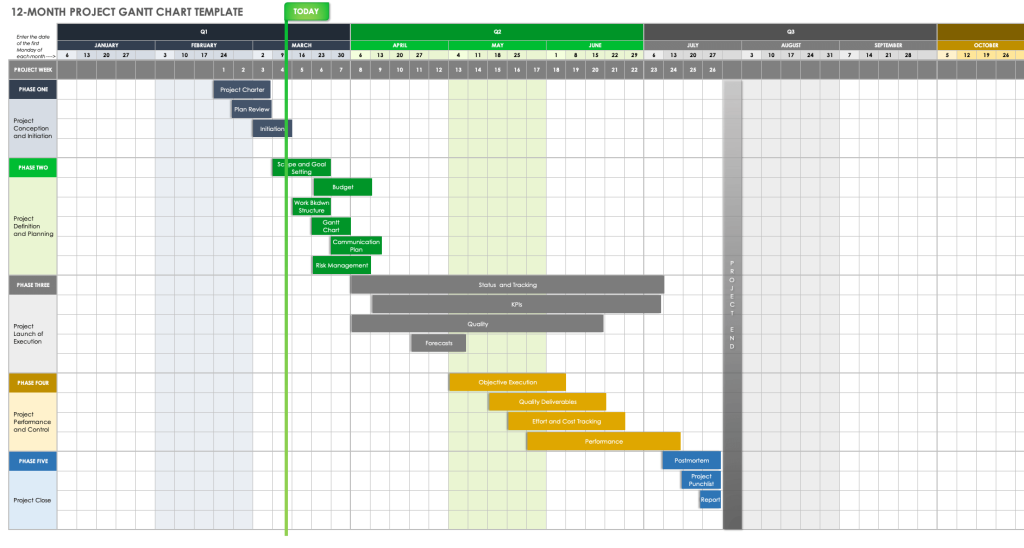

This section is going to depend heavily on your business goals and objectives. The key here is to identify the major projects that need to be completed in order for your business to advance towards its goals, then, break those goals up into smaller actionable steps. A Gantt chart is helpful for this section and should be included in your business plan.

Some things to consider:

- Opportunities listed in your SWOT analysis

- Goals and objectives that can be accomplished within the next 12 months

- Leadership development opportunities highlighted in your key personnel section

- Marketing & promotional objectives outlined in your marketing plan

- Create social media pages

- Hire a social media manager

- Post 10 times per month on each platform, etc.

- Define job description and compensation for new position

- Post ad on indeed

- Conduct interviews, etc.

This might look confusing if you’ve never worked with Gantt charts before, but I recommend doing a bit of research on how they work and how to use them as they are highly effective project management tools. The basic idea behind the Gantt chart is that it gives you a high level overview, at glance, of all the various projects you have in motion at any given time, broken down by their individual steps. In the sample chart above they have the chart broken down by phases. Each color coded box on the timeline represents an individual step in the process of a specific phase in their overall plan.

In your case, you’ll replace “phases” with your key objectives, and when you plot the steps you’ve broken down for each key objective according to their respective timelines, you’ll be able to see from a birds-eye view exactly how each step factors into the bigger picture, as well as where you’re currently at in the midst of things.

Another strength of using a Gantt chart to map out your operations plan is that it allows for easy delegation across teams. Instead of trying to assign a broad and complex task like “developing a new product” to one of your team members, you can map out the individual steps in that process and then assign them on a granular level. And if you’re using project management software, your entire team will always be on the same page knowing exactly what’s in progress, what’s been completed, and what still needs to be done.

Financial Projections

If you’ve made it this far, congratulations! This has been a very long article. Fortunately, we’re almost done here. The last step (before going back to complete your executive summary) is to provide some financial projections.