Table of Contents

What is an Annual Report for Michigan LLCs?

The Michigan LLC Annual Report is a yearly filing requirement that must be completed for all Michigan LLCs. The purpose of the annual report is to update your business information with the state, including:

- LLC name and address

- Information about the registered agent on file for the LLC

The state of Michigan requires an annual report to be filed every year for Michigan LLCs to ensure that records remain up to date. This allows creditors and other interested parties to find your business address and the address of the registered agent in case they need to contact you regarding important legal matters. The government also uses this information for state tax purposes.

How much does it cost to file an Annual Report for a Michigan LLC?

The state of Michigan charges a small fee of $25 to file an annual report. This fee must be paid for each filing, and can not be waived or avoided. At a minimum it will cost you $25 per year, every year, for the life of your LLC.

Do I need to file an Annual Report for my LLC every year?

Yes. As the name implies this report is due every year. The annual report is required even if your business was not active and did not generate any profit or loss during the year, which means that you still need to file an annual report for your Michigan LLC even if you don’t report the entity on your income tax return.

When is the Michigan LLC Annual Report due?

The annual report is due by February 15th every year. A good way to remember this is that it is the day after Valentines Day!

New businesses may not be required to file immediately, however. The state of Michigan uses your LLC formation date to determine when your first annual report is due.

If your LLC was formed between January 1st and September 30th, than your first Annual Report is due no later than February 15th of the following year. If your LLC was formed between October 1st and December 31st, then your first Annual Report is due no later than February 15th two years later.

This prevents business owners from having to pay the $50 fee to file their Articles of Organization, and then having to pay the another $25 fee to file an Annual Report immediately afterwards.

Penalties for failure to file Michigan LLC Annual Reports

The monetary penalties for failing to file your annual reports are not severe. There is a two year grace period for Annual Report filings, which means that as long as you file within 2 years of the due date there are no late fees or penalties. Nothing much will actually happen if you file your Annual Statement in August instead of February…

After the two year grace period, your LLC will be considered “Not in Good Standing” with the state, and you’ll be required to file a Certificate of Restoration ($50 filing fee) along with each missing annual report ($25/each) to restore your LLC.

The real danger of failing to file your Michigan LLC annual statement is that when your LLC is not in “Good Standing” with the state, you lose your name protection. Anyone can come along and steal your business name, and if that happens they may try to charge you a hefty fee to buy it back, or, they may flat out refuse to give it back to you which means you’ll have no choice but to choose a new name. This can have a major negative impact on any business.

Additionally, banks and financial institutions will often refuse to do business with LLCs that are not in “Good Standing” with the state. If your LLC has lost it’s good standing status, chances are you will not be able to open any new accounts or make changes to any existing accounts until your LLC has been restored.

How to file Michigan LLC Annual Report

Filing the report is a simple process. It can be accomplished in about 5 minutes online.

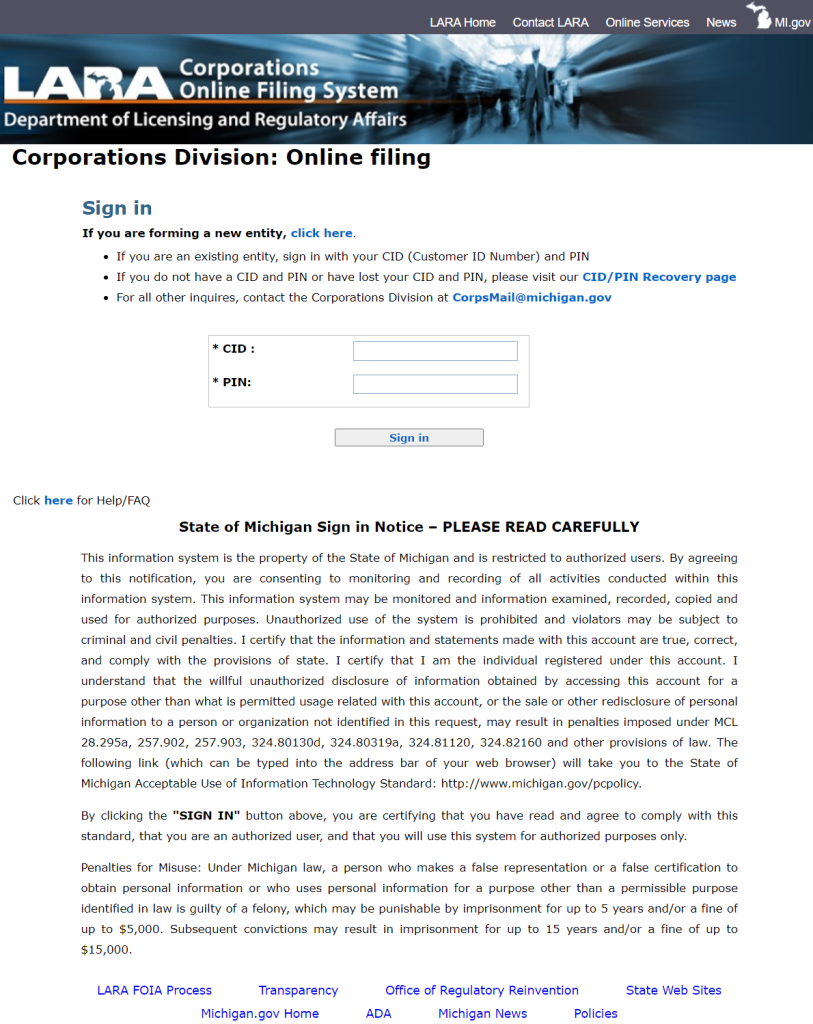

Step 1 - Log into COFS

Click here >> to access the Michigan Department of Licensing and Regulatory Affairs (LARA) Corporations Online Filing System (COFS).

You should reach the following page

Once here, simply log in using the CID and PIN number assigned to you when you formed your LLC

Step 2 - Choose the Document to File

After logging in successfully, you’ll reach the following page:

Simply click where it says “Annual Statement” to highlight the item as shown, and then hit the button that says “Select” to proceed.

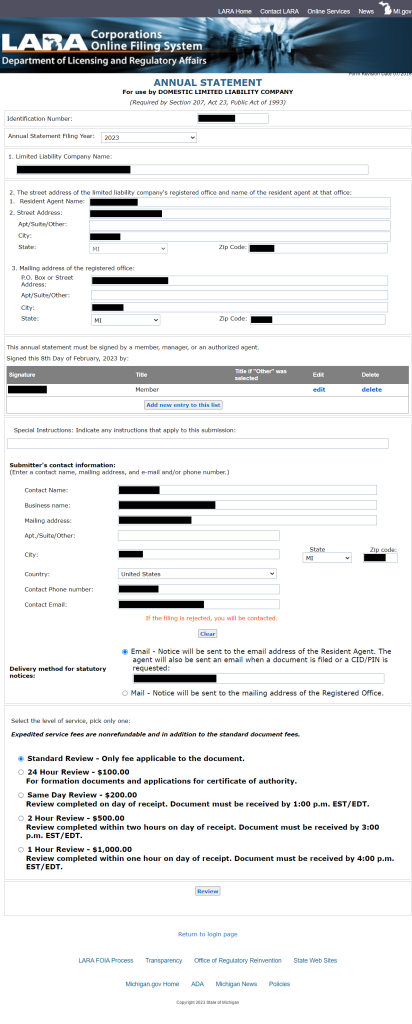

Step 3 - Complete the Annual Report

You should reach a window that looks like this:

This is the Annual Report. Most of it will be prepopulated for you based on the information that the state of Michigan already has on file for your LLC. If you don’t need to make any changes, then simply select the appropriate filing year in the dropdown box at the top, then click where it says “Add new entry in this list” near the middle of the page to add your electronic signature to the document, and then enter your contact information in the second section where it asks for “Submitters contact information”.

Note: if no dates are available to select in the dropdown box at the top, it means you are already up to date and are not required to file an Annual Report at this time. Feel free to simply close the page and come back to it at a later date.

If you need to change or update your business information you can do so by editing the prepopulated information in the first section directly below the dropbox titled “Annual Statement Filing Year”

Once this report has been completed and you are ready to submit it, hit the button at the bottom of the page that says “Review” and then click “Submit”.

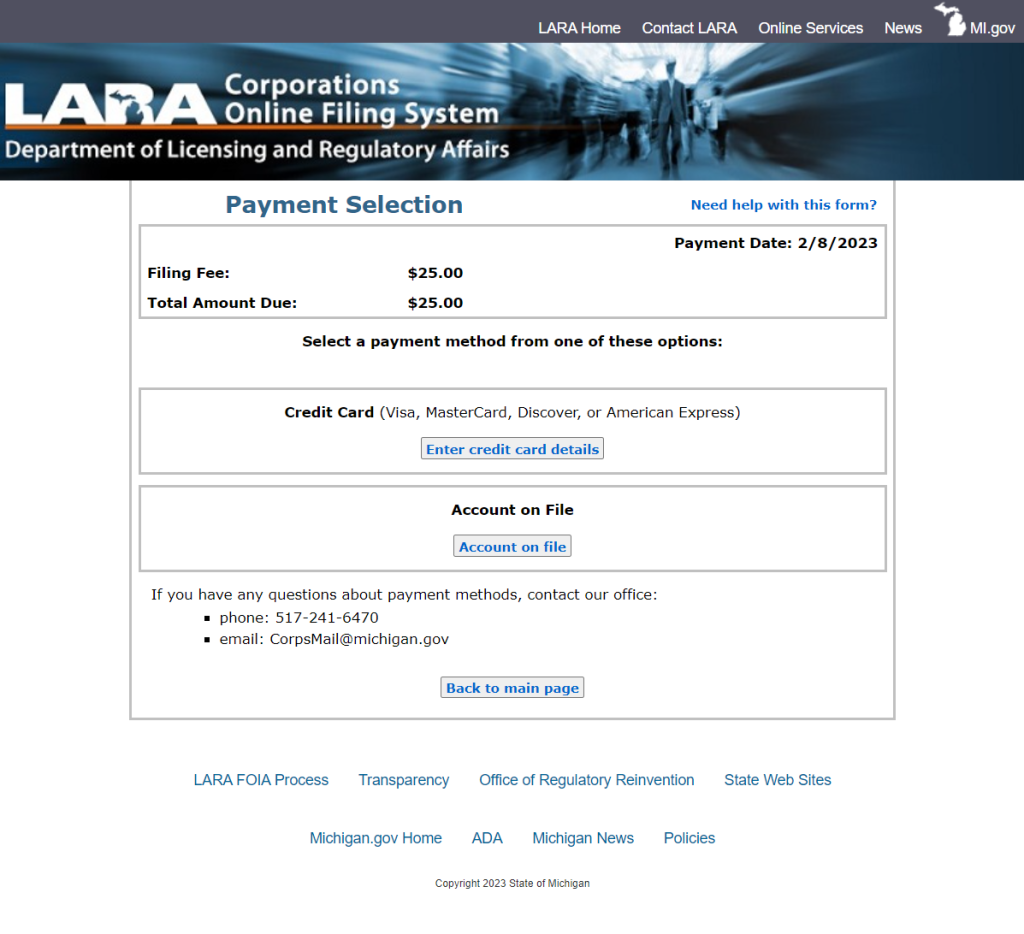

Step 4 - Payment

Once the annual report has been submitted, COFS will take you to a new page to collect the $25 filing fee. It should look like this:

If you have an account on file, you can pay via this account. If not, click “Enter credit card details” to pay.

Step 5 - Confirmation

After successfully completing the payment you’ll reach a page that looks like this:

Once you’ve reached this page, you’re done. You’ve fulfilled the Annual Report filing requirement, and you can feel free to close the browser.

You’ll also receive a confirmation email from noreply@fiserv.com at the email address you listed under contact information.

Once the state of Michigan has reviewed and approved your filing, you’ll get another email with the endorsed filing for your records.